So here's the deal, folks. The 571 L form has become a buzzword in the tax world lately, and for good reason. It's not just another form—it's a game-changer for individuals who need to explain their tax situations. Whether you're dealing with underreported income or simply want to clarify some financial details, this form can be your best friend. Stick around because we're diving deep into everything you need to know about the 571 L form, from its purpose to how it impacts your life.

Now, I get it. Taxes can be overwhelming, right? But don't worry. This guide is here to break it down for you in a way that's easy to understand. We'll cover the ins and outs of the 571 L form, why it matters, and how you can use it to your advantage. So whether you're a seasoned tax pro or just starting out, this article has got you covered.

Here's the kicker—taxes don't have to be scary. With the right tools and information, you can navigate them like a pro. And guess what? The 571 L form is one of those tools. So let's dive in and explore why it's so important and how it can help you out when dealing with the IRS.

- Unraveling The Mystery Of Incident In Ghostland

- The Intriguing World Of Therealmrspoindexter Onlyfans Leaked Content

Table of Contents

- What is the 571 L Form?

- Why is the 571 L Form Important?

- Who Needs the 571 L Form?

- How to Fill Out the 571 L Form

- Common Mistakes to Avoid

- Tips for Submission

- Frequently Asked Questions

- Legal Considerations

- Benefits of Using the 571 L Form

- Conclusion

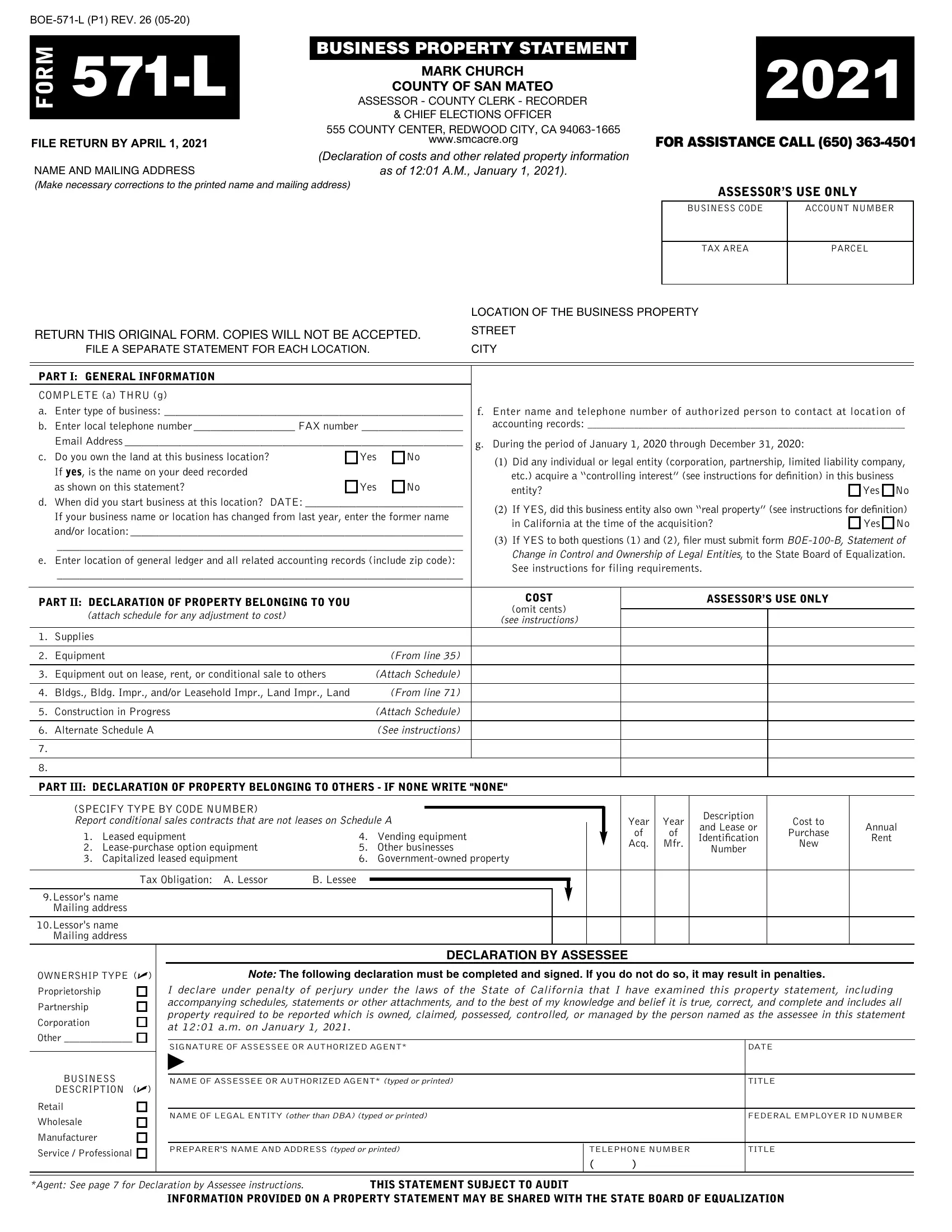

What is the 571 L Form?

Alright, let's start with the basics. The 571 L form is essentially a document that allows taxpayers to explain discrepancies in their tax filings. Think of it as your chance to tell the IRS, "Hey, here's what happened." It's like a personal note to the IRS where you can clarify why certain numbers don't add up or why something looks off on your tax return.

Now, this form isn't just for big mistakes. It's also useful if you've got some minor issues that need explaining. Maybe you forgot to report some income, or maybe you've got a legitimate reason for underreporting. Whatever the case, the 571 L form gives you the platform to set the record straight.

- Mastering The Art Of Seo How To Effectively Check Keyword Rank

- Exploring The Nationality Of Reece Walsh

Why You Should Care

Here's the thing, folks. Ignoring issues with your tax filings can lead to bigger problems down the road. The IRS isn't known for being forgiving, and if they catch something fishy, they'll come knocking. But with the 571 L form, you can take control of the situation and address any concerns before they escalate.

Why is the 571 L Form Important?

Okay, so you're probably wondering, "Why should I care about this form?" Well, let me break it down for you. The 571 L form is crucial because it gives you the opportunity to explain yourself to the IRS. Without it, you're leaving things to chance, and trust me, that's not a good idea.

Here's the deal. The IRS is all about accuracy and transparency. If there's a discrepancy in your tax filings, they want to know why. And if you don't provide an explanation, they might assume the worst. But with the 571 L form, you can show them that you're proactive and responsible.

How It Protects You

Think of the 571 L form as your shield against potential audits. By providing a detailed explanation of any discrepancies, you're reducing the chances of the IRS digging deeper into your finances. And let's be honest, no one wants to deal with an audit. So why not take the necessary steps to avoid one?

Who Needs the 571 L Form?

So who exactly needs to fill out this form? Well, it's not just for everyone. The 571 L form is specifically designed for individuals who have discrepancies in their tax filings. If you've underreported income or made other errors, this form is for you.

But here's the thing. Even if you think the issue is minor, it's still worth addressing. The IRS doesn't care about the size of the problem—they just want it resolved. So if you've got anything that needs explaining, the 571 L form is your go-to solution.

Common Scenarios

- Underreported income

- Unclaimed deductions

- Misreported expenses

- Errors in filing status

How to Fill Out the 571 L Form

Alright, now that we've covered the basics, let's talk about how to actually fill out the form. Don't worry, it's not as complicated as it sounds. The key is to be thorough and accurate. You want to make sure you're providing all the necessary information to the IRS.

Start by gathering all your financial documents. This includes bank statements, receipts, and any other relevant paperwork. Then, sit down and write out a clear explanation of the discrepancy. Be specific and detailed—this isn't the time to be vague.

Step-by-Step Guide

- Gather all necessary documents

- Write a clear and concise explanation

- Double-check for accuracy

- Submit the form to the IRS

Common Mistakes to Avoid

Now, before you dive in, let's talk about some common mistakes people make when filling out the 571 L form. These are things you definitely want to avoid if you want your submission to go smoothly.

One big mistake is being too vague in your explanation. Remember, the IRS needs specifics. Another common error is not including all the necessary documentation. Make sure you've got everything you need before you submit the form.

How to Stay on Track

Here's a tip. Before you submit the form, take a step back and review everything. Ask yourself if you've covered all the bases. If something feels off, double-check it. It's always better to be safe than sorry when dealing with the IRS.

Tips for Submission

Alright, let's talk about submission. There are a few things you can do to make sure your 571 L form gets processed smoothly. First, make sure you're submitting it to the right address. The IRS has different offices for different regions, so double-check where you need to send it.

Another tip is to keep a copy of everything you submit. This way, if there's any confusion or delay, you've got proof of what you sent and when. And finally, consider hiring a tax professional if you're feeling unsure. They can help ensure everything is done correctly.

Staying Organized

Organization is key when it comes to tax filings. Keep all your documents in one place and create a system that works for you. This will make the process much smoother and less stressful.

Frequently Asked Questions

Got questions? We've got answers. Here are some of the most common questions people have about the 571 L form.

- How long does it take to process?

- Can I submit it online?

- What happens if I make a mistake?

Legal Considerations

Now, let's talk about the legal side of things. It's important to understand that submitting the 571 L form is a legal obligation if you've got discrepancies in your tax filings. Ignoring it can lead to penalties and other legal issues.

But here's the good news. If you address the issues promptly and accurately, you're much less likely to face any legal trouble. So take the time to get it right—it's worth it in the long run.

What to Expect

Once you've submitted the form, expect some communication from the IRS. They might have follow-up questions or need additional documentation. Stay responsive and cooperative, and everything should go smoothly.

Benefits of Using the 571 L Form

So what are the benefits of using the 571 L form? Well, for starters, it gives you peace of mind. Knowing that you've addressed any discrepancies in your tax filings can be a huge relief. Plus, it helps you avoid potential audits and penalties.

Another benefit is that it shows the IRS you're responsible and proactive. They appreciate taxpayers who take the initiative to resolve issues, and it can go a long way in building trust with the agency.

Conclusion

Alright, folks, that's a wrap on the 571 L form. As you can see, it's an incredibly useful tool for anyone dealing with discrepancies in their tax filings. By taking the time to fill it out correctly and submit it promptly, you can avoid a lot of headaches down the road.

So don't hesitate—take action today. If you've got any questions or need further clarification, feel free to leave a comment or reach out for more information. And remember, knowledge is power. The more you know about the 571 L form, the better equipped you'll be to handle any tax-related issues that come your way.

Now go out there and conquer those taxes like a pro!

- Unraveling The Reasons Behind Anthony Bourdains Divorce From Nancy

- Barron Trump Understanding His Medical Condition And Health Journey